Recessions & Risk

“The brains of humans contain a mechanism that is designed to give priority to bad news.” - Daniel Kahneman

There has been no shortage of scary headlines regarding the economy and the markets. The dreaded ‘R’ word is rolling across tickers, as news pundits jostle to predict when the next recession might arrive. Just like a weatherman predicting snow will fall in Canada, given enough time, they will eventually be proven correct as recessions form part of a normal, healthy business cycle, whether we like it or not.

In this backdrop, the tech-heavy and former Wall Street darling NASDAQ is deep in the red posting an almost 25%[i] loss so far this year. Incredibly, the ‘safe’ Canadian bond market (FTSE TMX Cdn Universe) has suffered double-digit losses, losing 11.6% to May 6th[ii].

It would seem there is no place to hide from the carnage on the markets given the sea of red across all major indices. Both conservative[iii] and balanced[iv] index investors are seeing -10%+ losses so far in 2022, with no end in sight to the damage to their bottom line. After almost a decade of strong returns, a bear market has arrived and is leaving no stone unturned.

The Innova Tactical Asset Allocation Private Pool has benefited from its diversification outside of conventional markets but was not immune to the broad-based sell-off. From Jan 1st to May 6th, the fund was down -4.68%. Despite the negative, we are pleased to have contained losses at less than half of what a diversified index conservative or balanced portfolio would have seen over this time period.

The newly launched Innova Growth Pool is designed to generate above average returns by increasing market exposure, and so has felt the brunt of the damage, losing 10% to May 6th. We launched the fund at a point where a lot of the stocks in the portfolio were already down significantly (30-40%), and so we still feel like we have a decent entry point. In hindsight, launching now would have been even better though we remain committed to the long-term opportunities of our core holdings given the disruptive nature of our investments in high-growth sectors like the Healthcare, eGaming and Blockchain.

Despite the abrupt turn in market sentiment and the recent flashing of the ominous yield-curve indicator, we still believe that economic fundamentals are strong across a variety of indicators, and this leads us to believe that the core driver of security prices – profits – are still healthy.

From an economic point of you, all of these potential items could add fuel to an already “overheated” economy:

- Employment and wage growth are very strong, with most employers reporting the inability to fill vacancies[v].

- Pent up demand for many goods, services and travel[vi]

- Consumers sitting on substantial savings[vii]

- Immigration re-opening, which could spur further economic development[viii]

- China lockdown detracting from the economy[ix] yet pledging an ‘all-out’ effort to boost the economy through infrastructure development[x]

- The reconstruction of Ukraine[xi]

- Inflation driven in large part by food & energy[xii], and supply constraints

Fundamentally, rates are rising because inflation, and in turn, the economy is running hot. The question on everyone’s mind is whether or not the doctor will apply the right amount of medicine… Too few rate hikes and inflation destroys wealth. Too many rate hikes and an economic crash destroys wealth. The hope is for the fabled ‘soft landing’, the goldilocks of economic policy, but everyone is on pins and needles to see how the balancing act will go.

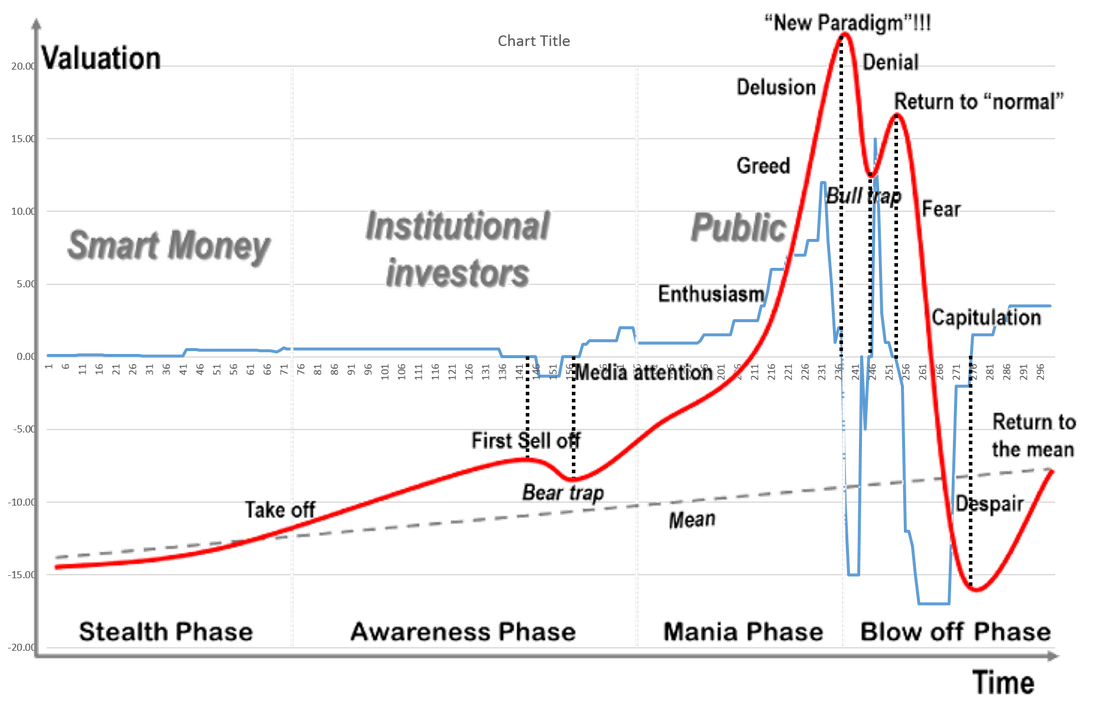

Meanwhile, the markets have gone from greed to fear, following the classic market cycle.

Source: Forbes, Dr. Jean-Paul Rodrigue

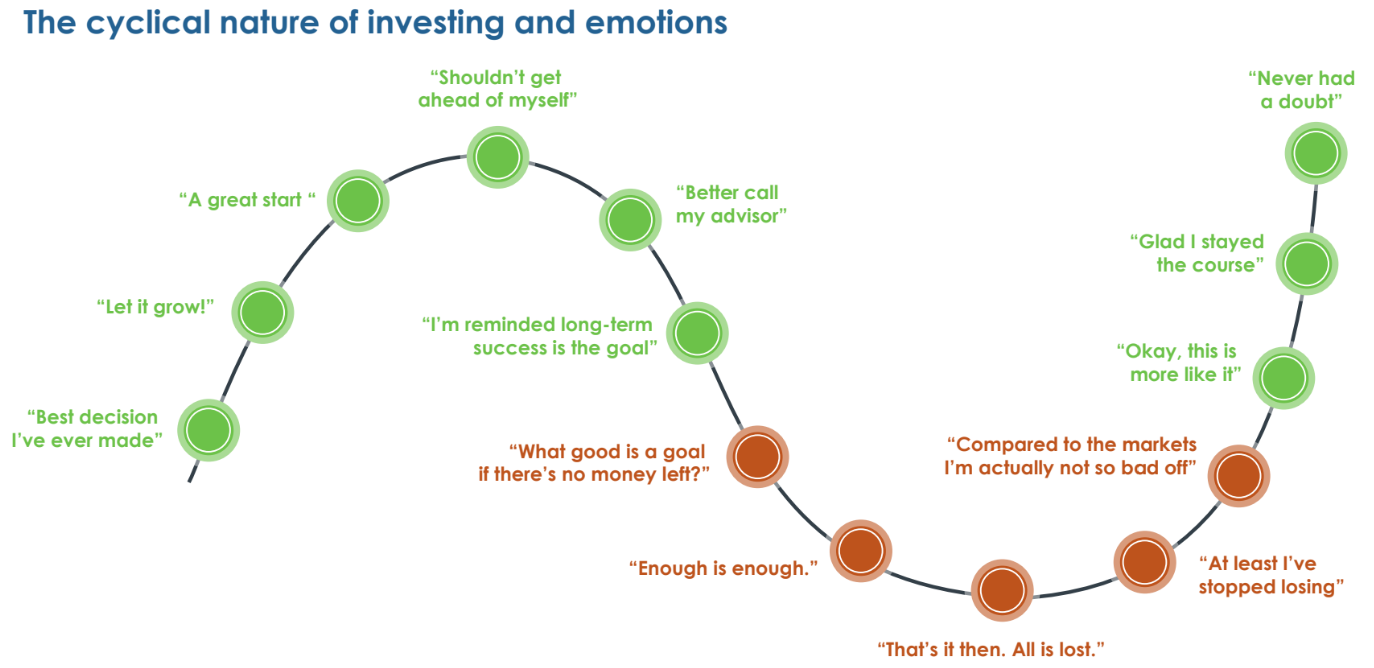

And alongside that chart is the internal dialogue that comes with it.

Source : Fidelity Investments

In this context, we do not feel we have entered the lows of ‘despair’ quite yet and believe that there may very well be more pain to come on the broad markets.

This is because the damage has been most prevalent in the ‘Bubble Stocks’ that sky-rocketed up in value with no connection to economic fundamentals, in our view. The broader market was saved from a great deal of this lunacy, but is being dragged down along with it, nonetheless. Famed investor Ray Dalio offers a great breakdown of the difference between the performance of the Bubble Stocks and the broader market in a historical context here: https://www.linkedin.com/pulse/popping-bubble-stocks-update-ray-dalio/

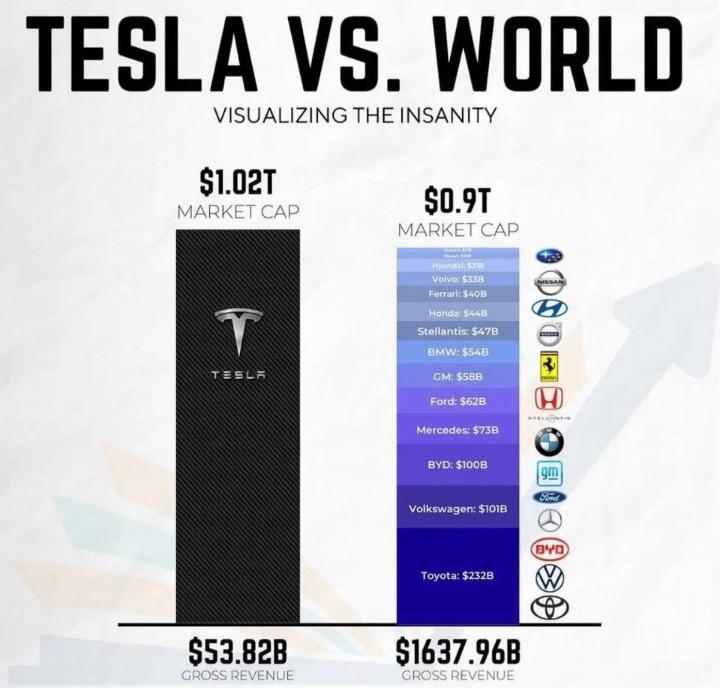

For anyone who may have needed proof that the markets had gone a little crazy, here’s a great chart showing the market value (market cap) of Tesla versus all other car manufacturers combined, compared to gross revenues:

One of the most important things to remember during times like these is that… This isn’t the first time, and this isn’t the last time the markets will go through their ups and downs. In fact, the last two years have been anomalies given their almost meteoric rise with very little downside.

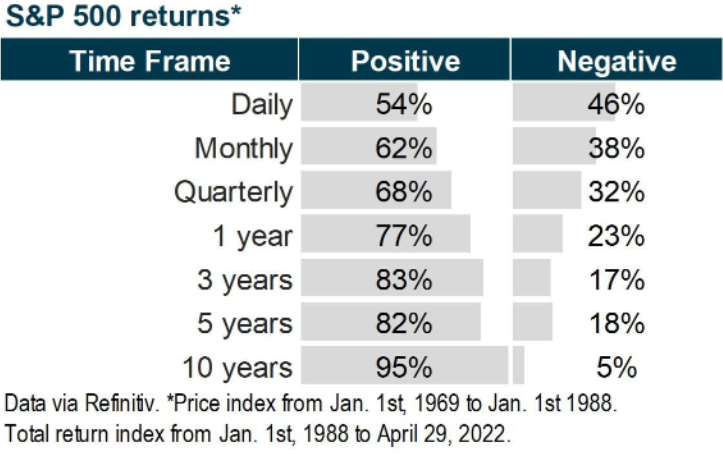

As you can see, markets produce positive returns on only 54% of days. Even over a 3-month period, markets are negative 1/3 of the time. Despite the sudden and violent swings that are common on the markets, we see the importance of taking a long-term approach to investing success.

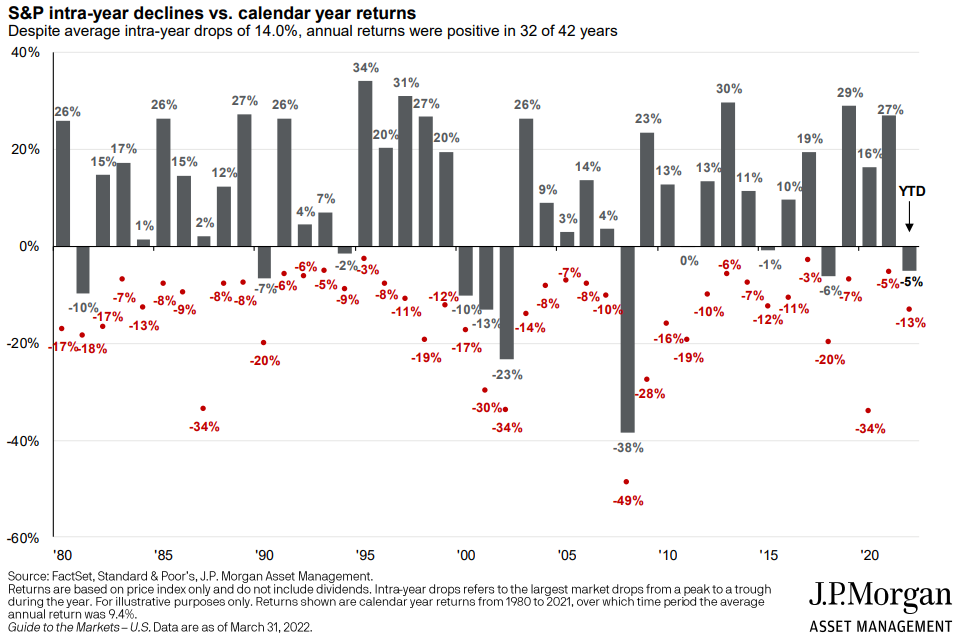

To put this into perspective, here’s a great historical chart that shows the calendar year returns (bars) VS the peak to trough loss (red dots) during that same calendar year.

Source: JP Morgan, Guide to Markets, April 30, 2022.

Notice how the current market drawdown is exactly in line with average intra-year losses, at -13%. 2020 is an excellent example of just how volatile markets can be. Although the S&P500 closed the year +16%, it’s peak to trough was -34%. Investors had to stomach about double the losses we’ve seen so far on the S&P500 to finish up the year double-digits! As one of the fastest stock market recoveries in modern history, it’s easy to forget how bad the markets got in March of 2020. And now, following two years of government intervention induced calm, investors have been lulled into a false sense of security that had them buying very risky stocks that were posting no profits, at any price. What we are seeing today is a reminder that profits matter and that markets will do what markets have always done… two steps forward, one step back.

To highlight how emotionally difficult this can be with technology stocks in particular, the following chart shows how the NASDAQ fared during the tech bubble burst, and how many false recoveries might occur along the way:

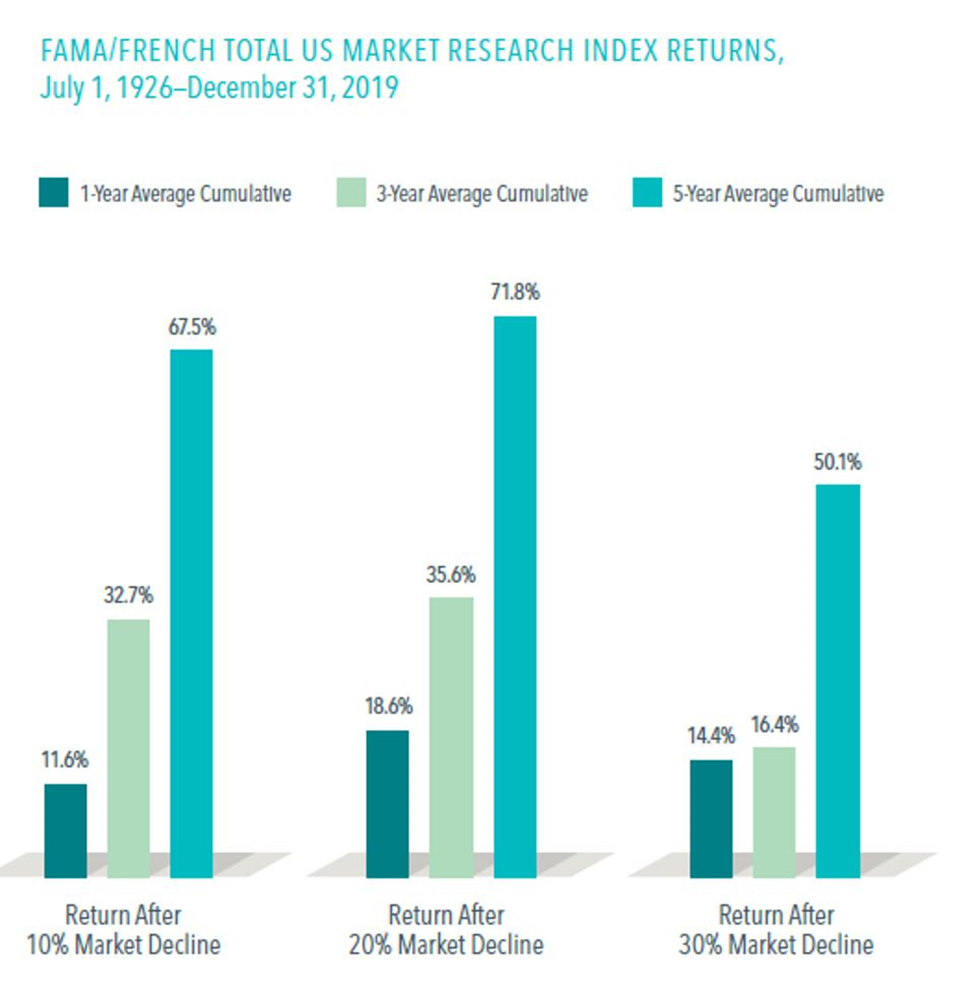

Our Tactical Asset Allocation strategy will seek to profit from these bumps along the road, while the Growth Strategy will remain fully allocated and deploy as funds are added. Given our entry point, historical returns support the potential for future profits in those positions as well.

As the online stock jockeys might say, it will take ‘Diamond Hands’ to thrive in the coming months, but we feel that our core positions can weather the storm and come out the other side with profits in tow, while we continue to focus on quality companies capable of generating profits through different market cycles.

Thank you for your continued trust in our stewardship. We remain available to you to discuss further, at your convenience.

[i] https://www.bloomberg.com/news/articles/2022-05-09/nasdaq-100-rout-erases-1-5-trillion-in-market-value-in-3-days#:~:text=The%20Nasdaq%20100%20is%20down,span%20of%20about%20a%20month.

[ii] TD Weekly Market Report for May 6th, 2022

[iii] https://www.morningstar.ca/ca/report/fund/performance.aspx?t=0P00008O4J

[iv] https://www.morningstar.ca/ca/report/fund/portfolio.aspx?t=0P0000M6H8

[v] https://www.ft.com/content/3a16e4e9-3bbd-4715-b29d-abc36abacbf0

[vi] https://globalnews.ca/news/8812005/u-s-summer-travellers-prices-travel-covid/

[vii] https://thoughtleadership.rbc.com/the-great-canadian-savings-puzzle/

[viii] https://www.ctvnews.ca/canada/canada-is-confronting-a-massive-immigration-backlog-this-is-what-it-looks-like-for-those-facing-delays-1.5892040

[ix] https://www.vox.com/23033466/shanghai-covid-zero-lockdown-interview

[x] https://www.cnbc.com/2022/04/27/chinas-xi-calls-for-another-infrastructure-push-as-covid-drags-on.html

[xi] https://www.investmentmonitor.ai/special-focus/ukraine-crisis/entire-cities-rebuilt-ukraine-reconstruction-russia

[xii] https://www.oecd.org/newsroom/consumer-prices-oecd-updated-4-may-2022.htm

Disclaimer:

*Innova Wealth Management is a trade name of Aligned Capital Partners Inc. (ACPI)* – if applicable ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Jean-François Démoré, Cliff Richardson or Brandon Beeson are registered to advise in (securities and/or mutual funds) to clients residing in Ontario.

This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Jean-François Démoré, Cliff Richardson or Brandon Beeson.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

- Hits: 8905